House Flipping in Canada in 2023 (+ Profit Formula)

House flipping in Canada can be very profitable, but it’s also a lot of hard work.

Many people are attracted to the idea of making money by buying and selling real estate. But many of these same people are discouraged when they discover that the business of flipping houses is not as easy as the half-hour TV segments. Investing in a business — and asset — that could quickly lose value can be stressful and costly.

Still, the profit margins on house flipping make it attractive; partly because the majority of home buyers want a move-in-ready home, not a fixer-upper.

To determine if house flipping is the right investment for your time or funds, consider the following simple, how-to guide on flipping houses in Canada.

What is House Flipping? Is Real Estate Flipping a Good Investment?

House flipping, as an investment strategy, occurs when you buy a property at one price, improve it through updates and home renovations and then sell the property at a higher price.

When done right, flipping properties can be a lucrative business. According to MillionAcres, In Q2 2018, house flippers in Canada made an average 44.4% return on their investment (ROI), about $64,000.

The Bank of Canada also recently reported an increased rate of flipping in the Canadian housing market and suggests that prices may have risen due to the “fear of missing out” on opportunities.

The Business of Flipping Houses

In Canada, house flipping is considered a business, and as such, profits from the sale of properties are subject to tax. Since house flippers are required to report their profits as business income on their tax return, they end up paying income tax, not capital gains tax, on their house flipping profits. House flippers must also register, collect and remit GST/HST sales tax (assuming their annual profits exceed $30,000 per year).

The Tax Cost of House Flipping

The amount of tax owed on house flipping profits will depend on several factors, including the individual’s tax bracket, the type of business structure they operate under, and any deductions or credits the individual or business may be eligible to claim. For example, if the house flipper operates as a sole proprietorship, they may be able to deduct expenses such as renovation costs, marketing expenses, and legal fees from their taxable income, which could help reduce their tax liability. The same deductions are available to corporations, but a T2 is a requirement during tax filing and more robust accounting documents may be required.

It’s important for house flippers to keep accurate records of all expenses and income related to their business to ensure they are reporting their taxes correctly. They may also want to consider seeking the advice of a tax professional to help them navigate the tax implications of house flipping in Canada.

To make a profit as a house flipper, it’s critical to be aware of market cycles; the supply and demand of housing in given communities, and changing tax laws. Failure to research the regulations and costs and house flipping can quickly turn sour.

How To Flip a House in Canada

Step 1: Get a team of professionals

Flipping a house is not something you want to attempt alone. Instead, you’ll need a team of experts who will help you through various phases of the process.

You’ll require the service of the following professionals:

- Real Estate Agent

Ideally, you should choose a real estate agent who has experience working with house-flipping investors. They should be familiar with popular neighbourhoods and have enough knowledge about flipping houses to help you assess whether a property is worth flipping.

- Contractors

The belief that sweat investments will result in larger profits is the reason why some investors do their own renovations. In the end, they don’t! A person who already has a team in place will help you make the right estimates as well as keep up with your timelines.

Step 2: Determine Your Funding Options

It’s important that you have access to money when you’re starting a property-flipping business. However, when you lack the funding to flip a house or you want to minimize your risks, there are several funding options to opt for:

- You may qualify for a conventional bank loan if you meet the lending requirements. Although, the approval process for financial institutions’ lending options can often be complex, and approval is largely determined by your credit score.

- You can also utilize alternatives such as private money lenders, or go into partnership with a firm that provides real estate crowdfunding. The advantage of this type of funding is that it can be more accessible than traditional forms of borrowed money. The disadvantages include higher rates, stricter terms, and fewer prepayment privileges.

Step 3: Prepare a business plan and budget

Your business plan does not have to be an elaborate document. However, it should include details about the scope of renovations, budget, and timeline.

Scope of Renovations

As a new house-flipping investor, it might be best to stick with homes that do not require complex renovations. We recommend buying houses that’ll only require cosmetic updates: new flooring, paint, and fixtures. (You may, also, want to set aside money in your budget for staging the home for sale. Data shows that a staged home typically sells for more than a property that has not been staged or an empty property listed for sale.)

Budget

How much would you like to invest in the home? What is the amount you are leaving as a buffer for sudden emergencies?

Timeline

Get estimates from your contractor on the time to complete different projects so you can estimate the period of time it will take to sell the house.

Taxes

As of April 2022, all renovators and real estate investors will need to consider the crackdown on flipping houses for a profit.

Property flippers made it onto the federal government’s radar this year, as housing affordability remains impossibly high for many, particularly in larger cities. The feds introduced rules to fully tax profits on homes that are sold within 12 months of being purchased. The idea is that the business of buying, renovating, and then selling a home requires that the profit triggers income tax (business tax), not capital gains tax. For house flippers, this means that 100% of their profits will now be subject to taxation, rather than the more favourable 50% when capital gains tax is triggered. Exemptions to the rule will be homeowners who experienced major life events such as the birth of a child, divorce, death, disability, or a new job.

Even before the Federal Liberals announced these changes in April 2022, the Canada Revenue Agency (CRA) was already going after house flippers who weren’t honest about reporting their earnings. In recent years, the CRA was cracking down on taxpayers who, in its view, are inappropriately claiming the Principal Residence Exemption (PRE) — where no tax is owed on the sale of a principal residence — and on house flippers that claimed a capital gain rather than pay tax on 100% of the profit earned on the flip.

Step 4: Buy the House

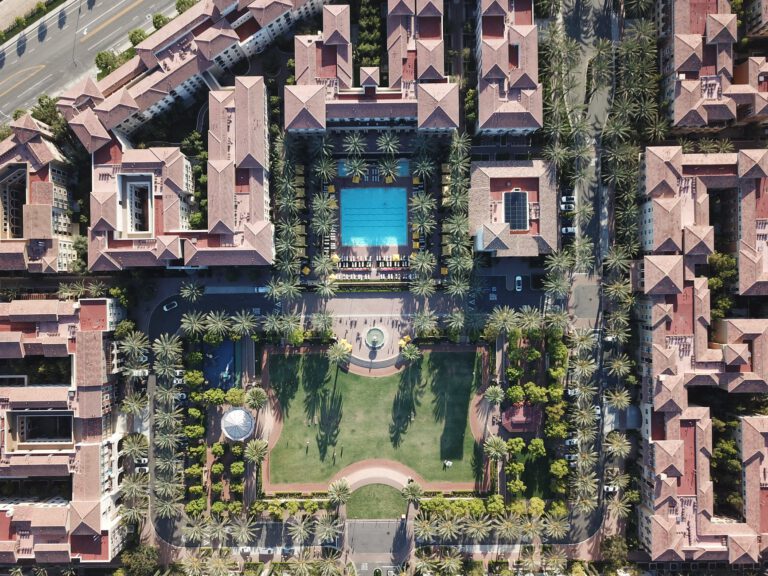

When buying a house, you should choose a great location with a longstanding record of high home sales. It’s a huge mistake to flip a house that will be difficult to sell, so make sure you do your homework on the location you’re choosing.

You should purchase a property in an area that supports higher prices. You also want to be aware of any potential repair issues with the property before you might have to foot the bill for them. Work with an experienced realtor that can help you find great deals so you’ll have wide enough margins to cover other expenses.

Step 5: Renovate the House

The moment you purchase the property, you are on the clock. Every month you’ll pay carrying charges — mortgage, interest, insurance, utility bills, and property insurance. The faster you can complete the renovations and sell the property, the less money you pay in carrying charges and the more profit you earn.

To help speed up this process, have a plan in place on how you want to renovate. Talk to your city’s building and permit department to learn how the permit and approval process works and get your team of renovation professionals on notice, so you can start work as soon as you have the right permits.

For house flippers, it’s important to remember:

- Homebuyers are influenced by visuals — so renovate to appeal to the senses;

- You are legally responsible for damage or disrepair if you fail to disclose a latent problem with a home. However, you are no longer legally responsible, if you disclose the problem and the method of how it was fixed;

- Be sure to stay with neighbourhood standards — overbuild and you risk diminishing your overall return on the project.

Step 6: Sell the House

As soon as your renovations are complete, you must set an asking price for the project. Check with your Realtor to set the right asking price. Make sure your price is good enough to draw buyers, cover your expenses, and generate enough profit.

Your real estate agent will be able to estimate the listing price based on factors such as the location, liveability and lifestyle, and the price of other properties in the neighbourhood.

Remember, to set aside a portion of your profits as you will owe taxes on the money earned on the sale of this flipped property, regardless of the type of property.

Use the 70% House Flipping Rule to Guarantee A Profit

While there are many schools of thought when it comes to house-flipping formulas, the overall aim is to find a method that allows you to earn a profit for all your hard work. To do this, you need to remember that house flipping needs to appeal to the potential buyer’s emotions, but your emotions must stay out of the transaction. Instead, focus on the math. When you examine the cost to purchase, pay for permits, pay to renovate, and include the taxes owed, are you making a profit? If the margin between costs and earnings is thin, it may not be the right property to flip.

One rule of thumb method used by many flippers is the 70% After-Repair Value (ARV) rule. According to this house flipping rule, a flipper’s overall costs should not exceed 70% of the home’s expected market value, once it’s back on the market.

For instance, if a house flipper bought a home for $250,0000 and, after working out the math, expects to sell the home for $450,000, then the renovation costs, permits, and taxes owed cannot exceed, $65,000.

- $450,000 x 70% = $315,000

- $315,000 – $250,000 = $65,000

Work with a real estate agent to get an accurate ARV estimate. You should also meet with contractors to discover what kind of repairs and renovations are required and the cost of repairs.

Final Thoughts

For those who have never done it before, flipping a house might seem intimidating. However, you can significantly improve your chances of being successful at it if you do your homework and partner with experienced professionals.